How to Save Your Commercial Real Estate Equity Fund During Economic Downturn – Capital Raises – Real Estate Capital Raises – Mergers and Acquisitions Capital Raises

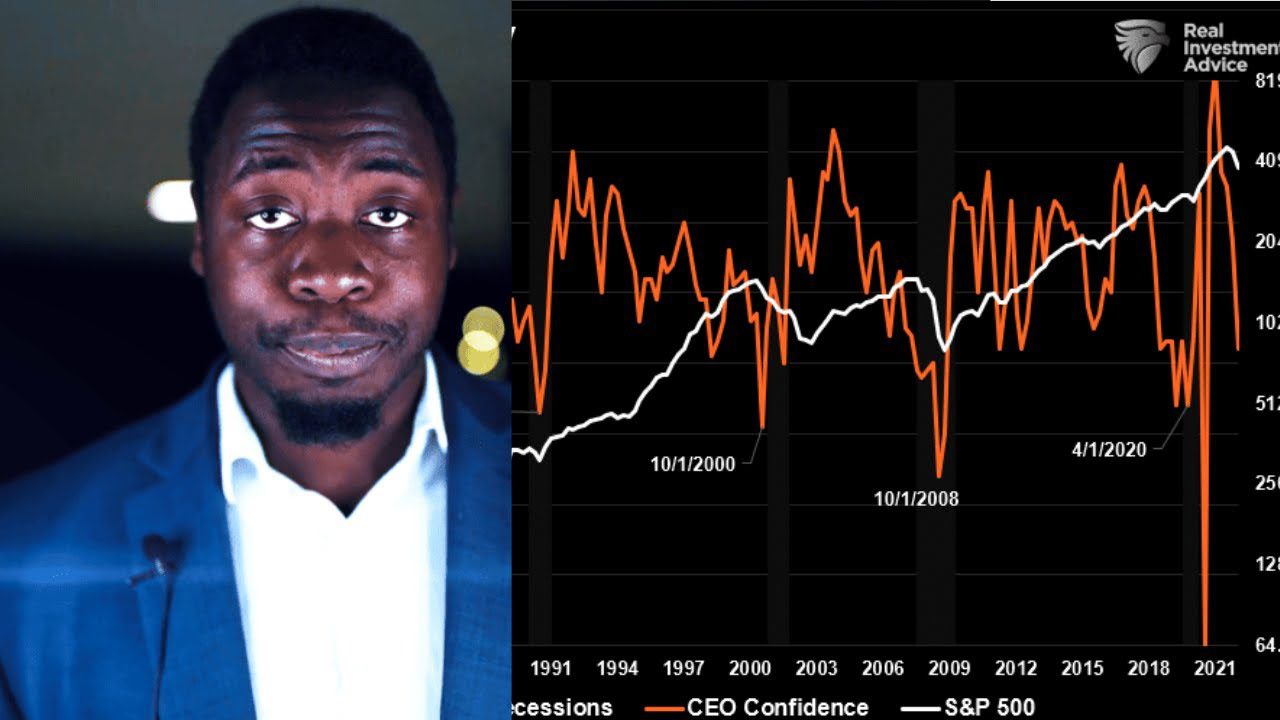

[00:00:00] This video. I’m going to show you the tried and true principles of making sure that your private equity capital raise for real estate or for mergers and acquisitions actually can get a solid return for investors even during a potential recession. So it all starts with understanding both the yield and the capital appreciation. The two main types of returns and the two things that are usually emphasized during a private equity capital raise is usually when people talk about the returns in terms of the yield pref return, IRR, as well as how people how people get compensated on the exits. Because broadly speaking, there are really two types of private equity funds that most people in the real estate private equity world usually focus on. Either there is the one off syndication, your raising capital to buy one building or to do one development, or there’s more of a blind pool fund where people are raising capital to acquire multiple deals. In an M&A world usually is this one deal at a time for most of the newbies that are just getting into this type of work. So what are some of the ways to prevent you from getting destroyed during this potential recession? So if you look at the average time that most recessions last, most recessions lasts about one year, about 1 to 2 years. So if you look at how the if you look at the fact that most recessions last since 1950 lasted about, you know, around 15 months on average, 10 to 15 months, you can structure your capillaries around this.

[00:01:27] And the way to do this is to make sure that when you exit, you’re exiting at a higher value of when you enter it. Very simple. Right? And so part of the resistance is really making sure that when people exit the value, that people are exiting at your exit and investors at your selling your deals at that you’re disposing of your deals at is much higher than when you came in. So the best way to do that, just like public equities, just like stocks, is to make sure you buy low, you sell high. But most people what what a lot of people do, they end up buying high and selling low just because of the timing, just because the timing was completely off. So as a result, there are a lot of people that are coming to us and saying, Hey, I want to get in at the bottom. I want to invest at the bottom, I want to jump in at the bottom. And when people are ready to do that, then they’ll be able to exit investors at a higher value. Most private equity funds, they seem to have a term of five years. So if you structure things such that you exit investors after the recession, which may be around two years or one year, you know, then you’re playing with power and you’ll be in a strong position to win.

How to Save Your Commercial Real Estate Equity Fund During Economic Downturn – Capital Raises – Real Estate Capital Raises – Mergers and Acquisitions Capital Raises

[00:02:35] Next, you want to make sure that you can provide consistent cash flows for your investors. So the way to provide consistent cash flow for investors is to make sure that the sources of your cash flow are uncompromised. Sources of cash flow can include, you know, if it’s real estate, it can include the cash flow from the from the rentals, from the people that are renting the property. If it’s commercial real estate, it’s the businesses that are leasing the buildings or the properties. So what are all the things that can prevent people from paying your rents when there’s a recession? You know, people have can get laid off. Twitter laid off about half of the staff. Forgetting the Elon Musk story, many companies are laying off their staff. And so people want to make sure that they have people that are they have renters that are in strong economic position. Either they have stable jobs, maybe they have public sector jobs or government jobs which are more stable, or they’re in areas where there’s low recidivism. Recidivism just means when people don’t pay it or don’t pay their bills, make sure that the unemployed make sure that you target properties and high employment rates and stable areas. Next, when it comes to the commercial deals, make sure that you target people that are leasing deals. Make sure that you work in a blue chip commercial companies, companies that are stable, these that will be in business even during recessions.

[00:03:53] Banks, you know, Fortune 500 companies, one of the $100 million real estate investment trusts that we’re setting up for one of our clients. You know, he’s targeting Fortune 500 to make sure that, you know, like McDonald’s and things like that that don’t go out of business. So make sure that you work with commercial deals with companies associated with the leases and the cash flow that are stable. What’s the master timing of the exit and entry to make sure that people leave at the best position that they can and you master protecting the cash flow and protecting the downside? The final thing comes down to making good and low risk terms. Making low risk terms means that you’re giving investors more than what you promised and you’re reducing their risk. The best way is to reduce the risk. Usually private equity funds, limited partner, general partner, set up for real estate. You know, usually you see 20% performance fees, 20% of the profits that you get, you keep for yourself. And then 80% of the other 80% give it to investors and then 2% on the management fee. So if you raise 1 million, then you’re taking 20,000 in annual fees just just for managing the money. So. Based on your experience level, you want to make sure that you offer as much bonuses and incentives as possible to reduce all risk.

How to Save Your Commercial Real Estate Equity Fund During Economic Downturn – Capital Raises – Real Estate Capital Raises – Mergers and Acquisitions Capital Raises

[00:05:07] For example, it can look like increasing the performance fee, increasing the management fee, and making sure that you just don’t take risks on properties that don’t fit within the things that can optimize for cash flow and for capital appreciation. Next, when it comes to the M&A deals, the same principles apply when it comes to loan to value ratios because the interest rates are going high and then the prices are going low. You know, many people, they want to make sure that they have a more conservative loan to value ratio. And making sure that you lower the loan to value ratio is just so that people feel more risk reduced can put you in a good position. Finally, make sure that you don’t work with things that you don’t understand. You and your team you’ve been investing in, let’s say, Class C multi families for 40 years. Don’t go and do stocks because you have extra money to deploy. Just make sure that you focus on your core competence because your core competence can also reduce risk. So that’s pretty much it. So number one, make sure that you protect the make sure that you enter and exit the market at the right time so that you can protect the investors capital because recessions usually last 1 to 2 years. So depending on when you get in the market, you may want to make a plan of projection for when you get out of the market that you’re at the peak.

[00:06:17] Number two, the other thing that’s important besides capital appreciation is also the cash flow. So protects your cash flow by depending on where the deal gets cash flow for your private equity fund in a real estate or M&A niche. If you’re working with renters, make sure that the renters have low recidivism during recessions by having stable jobs, perhaps in the public sector. If you’re working with commercial real estate, make sure that the businesses don’t go down during recessions. And there are blue chip businesses such as banks or Fortune 500 when it comes to risk and benefits just increase the benefit for investors as much as possible and reduce the risk. Reduce the risk by just having a conservative loan to value ratio. Don’t get too much debt when you don’t need it, and make sure you focus on your core competence. And then these tried and true principles will protect you during any type of economic recession, because these are principles that transcend tactics. These are tried and true repeatable principles that you always have to apply. But then they’re just, you know, accentuated during times of recession. So if this is something that you want to apply and put into work right now to protect you and your company and your family during the recession, just make sure you head to Raises.com for your equity fund.

Go to Raises.com/website to book a call as well for your equity fund.

Follow Raises.com on Linkedin by clicking here.