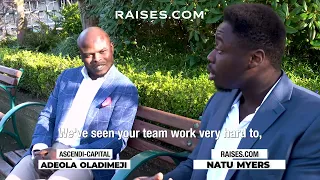

Natu Myers Asks How Adeola Oladimeji of Ascendi Capital Provide Returns to Real Estate Investors – Investment Banking

All right. So Addy, it’s great to discuss with you again about some of the, you know, the projects that you’re working on. Uh, we’ve seen your team work very hard to, you know, deliver outstanding results here. So when it comes to Ascendia Capital and, you know, some of the, you know, offerings that you’re, you’re building here, who is it for and who are some of the, some of the people that you’ve worked with?

And the stockholders, the investors that you’ve worked with, who is it ideally for? Um, primarily we work with, um, accredited investors. Those are our main targets. So, accredited investor upward, and you know the definition of it. Yeah. What, uh, the SEC or what you call, uh, SEC call accredited investor.

According to that definition, those are targets, audits, or offerings, uh, from accredited investors to iNetwork individuals. Investors, those are primary targets. Okay. No, understood. And so we noticed that you put a, you seem to put a lot of effort when it comes to wealth preservation Yeah. And preservation of wealth.

How did you do that and, and why is that important to you right now? Um, I, I’ve seen a lot of people invest in sharing objects, um, primarily because, uh, I’m not trying to cast as passion on some of the, uh, financial advisors of that. So they just. advice them on 60 40 equity in public securities and debts.

And most cases you could lose their money overnights, especially in stock markets because they have no control. Well, if you’re investing in a, in a private transaction, for instance, in real estate or power, something in the private market, there’s a bit of control as to what happens to that asset. You know, you might be a limited partner, but If your investor’s pull is no more than, on a deal, no more than let’s say 10 or 15, even that’s a like number, well there’s a bit of control as to what happens to that property.

You know, there’s regular, there’s regular report to your investors, so they know what’s going on, you know, keeping them updated and, and uh, uh, security has been, uh, our product has been, uh, what do you call it now, it’s been properly, uh, regulated, so we don’t We try as much as possible to ensure that our investors money or capital is preserved in whatever it is.

That’s the primary goal for us. Of course, we’re looking at, you know, uh, adequate return, but we’re not looking for uh, overnight return. We look at long term play, which is why capital preservation is very important because that’s the only way you can build generational wealth. Because for me, it’s all about simplicity, you know.

People understand real estate. People understand real asset. They know that their money can’t just disappear overnight. If you invest in real estate, you can point to the property. I can point to… It’s just paper if you invest in the stock market, for instance. I’m not against people that invest in the stock market.

I’m just talking about what I love. That’s real asset. And I try as much as possible to explain how we’re going to get there. This is what we want to do and this kind of asset we put in. So we don’t say we’re going to do A and we do B. We focus on A. If you have issues along the way, we’ll tell them, let them know that we’re having issues.

But we’re not going to move from A to B because we promised them A. So that’s, so it’s about integrity. It’s about transparency. It’s about alignment of interest. Yeah. Because, uh, We believe that if you invest, if we are saying that you put your money somewhere, we should be able to put our money in that deal as well.

So that’s, that’s alignment of interest. And I think, I think those are the key things that people look out for and, and our investors decide, okay, yeah, we’re going to partner with, uh, Ascendi, we’re going to partner with Adair and his team. I think that was, I think that was it. It’s about alignment of interest, about integrity, honesty, being open about everything.

You know, no bullshit. Make it simple.

Go to Raises.com/website to book a call as well for your equity fund.

Follow Raises.com on LinkedIn by clicking here.